EnWave CEO’s Message to Stakeholders

OCTOBER 03 2019, 06:30 AM

Continuous Improvement

EnWave Corporation has undergone many impactful changes over the past twelve months and as a result our financial performance has improved and will continue to do so. Our management team has been expanded and upgraded. We’ve added manufacturing capacity to deliver approximately twenty large-scale machines per year. NutraDried Food Company (“NutraDried”) has evolved from a proof-of-concept start-up to an emerging powerhouse branded snack company. The result? Our product sales, both Radiant Energy Vacuum (“REV™”) machinery and Moon Cheese, are at all-time highs.

With our fiscal year ending this past week and our financial statements scheduled to be published in December, I felt this was an opportune time to provide a corporate update and outlook for our stakeholders. We have made major advances, but still have plenty of room to run and will work harder to achieve more. We are not solely a cannabis pick-and-shovel company, an emerging technology licensing and royalty story, nor a fast-growing cheese snack company. We are all of the above.

Focus is Sharpening

EnWave’s mission is to accelerate our disruption of the global dehydration industry and become the most sought-after drying solution for companies at the forefront of the Cannabis, Dairy, Fruit and Vegetable industries. We also aim, through NutraDried – the makers of Moon Cheese, to be the most dominant shelf-stable dairy snack company in North America.

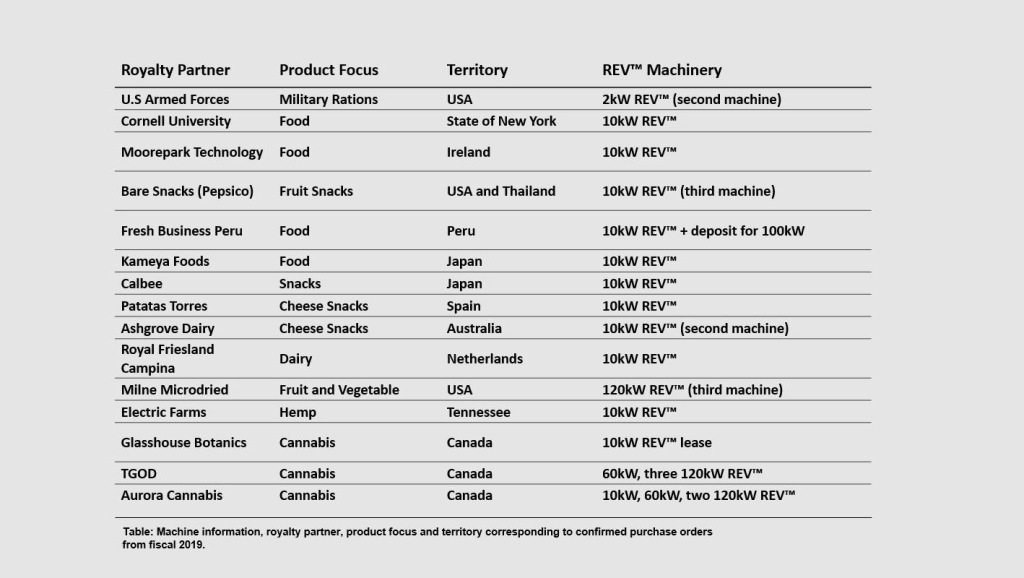

The value of REV™ technology is proven in the aforementioned market verticals and we intend to seize an even larger opportunity by leveraging this commercial momentum. All of EnWave’s machine sales in fiscal 2019 have come from these industries. On a global basis, we offer the most scalable and reliable vacuum-microwave technology, delivering the most comprehensive and innovative solutions to unlock value for our international partners. A few companies have tried to enter the space, but they have failed to provide competitive alternatives.

The rapid expansion of our royalty-bearing license portfolio in fiscal 2019 (32 confirmed licenses to date) proves that REV™ technology is becoming more known and demand is increasing. To accelerate business development and grow our top and bottom lines as fast as possible, EnWave will allocate the majority of its proactive energy in fiscal 2020 and 2021 towards proven market opportunities. That being said, we will continue to evaluate unique, inbound inquiries on a case-by-case basis and initiate projects that make commercial sense. We’re confident that our active pipeline of prospective licensees and focussed business development strategy will translate into a higher rate of commercial license and machine sale announcements in fiscal 2020. This focus on proven industries and product applications provides EnWave with tremendous untapped market opportunity for REV™ deployment to ultimately grow our installed royalty stream base.

The total kW for machine sales in fiscal 2019 was 1,102 kW, more than triple the sales of 300 kW in 2018.

Investing for Growth

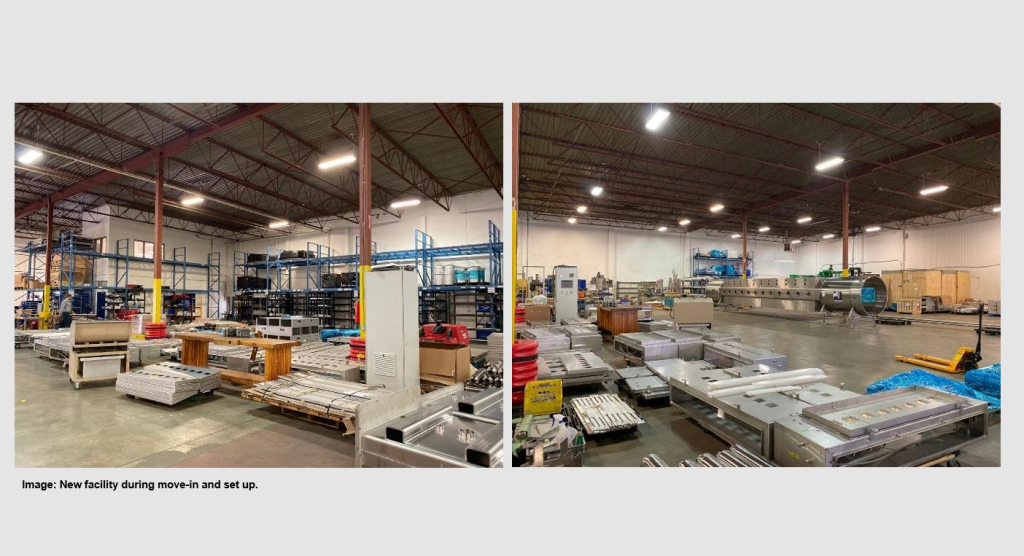

We expanded our engineering and business development teams in Q3 and Q4 fiscal 2019 in preparation to deliver the nine large-scale REV™ machines on order and to continue growing our royalty-partner pipeline. We secured an additional 21,000 sq ft of industrial space located 5-minutes from our current headquarters. With the new space our total footprint is now approx. 45,000 sq ft and we have the capacity for future growth in the number of machines we can deliver each year.

Our machine designs are becoming more standardized allowing for us to increase our outsourcing of components; therefore, we believe that the current overhead shouldn’t grow significantly as we continue to build more machinery.

REV™ Adoption in Cannabis

Cannabis has become the most promising near-term opportunity for EnWave machine sales and should result in meaningful long-term royalties for the company. The influx of large-scale REV™ machine purchase orders received in Q1 – Q3 fiscal 2019 has solidified a consistent healthy stream of revenue to be recognized into fiscal 2020. The global market for dehydration equipment in the cannabis industry is anticipated to reach US$167 MM by 2023 (Source: Zion Market Research). Our position is to pursue cannabis-related business in all legal environments that do not put our stakeholders at risk. We will continue to evaluate the potential entry into the massive U.S. market.

The current agreements with Aurora require additional large-scale REV™ machine orders through the next five years for Europe and South America. We are currently pursuing about two dozen new royalty partners in this space. Electric Farms (Tennessee-based hemp company) and Glasshouse Botanics (privately-owned Canadian cannabis LP) are the most recently announced new royalty partners in this vertical. Both acquired 10 kW REV machinery to validate REV™ technology firsthand.

EnWave successfully commissioned the first 60kW REV™ machine for Tilray at their Ontario-based facilities in July 2019. The commissioning of Tilray’s first 60kW machine confirmed the value that REV™ technology provides to cannabis companies. Our first cannabis-related royalties should be paid in Q4 fiscal 2019. The majority of machine orders received from TGOD and Aurora are slated to start-up in the first half of fiscal 2020.

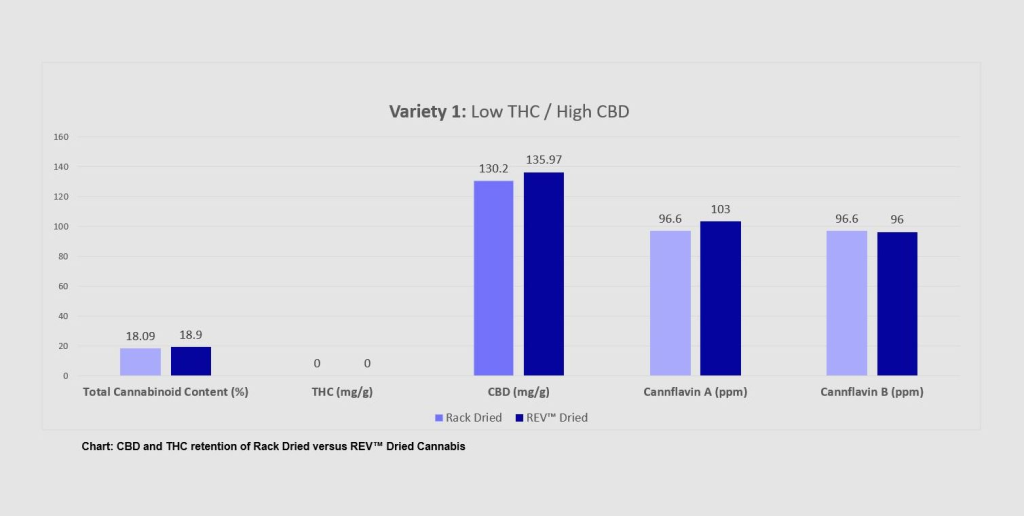

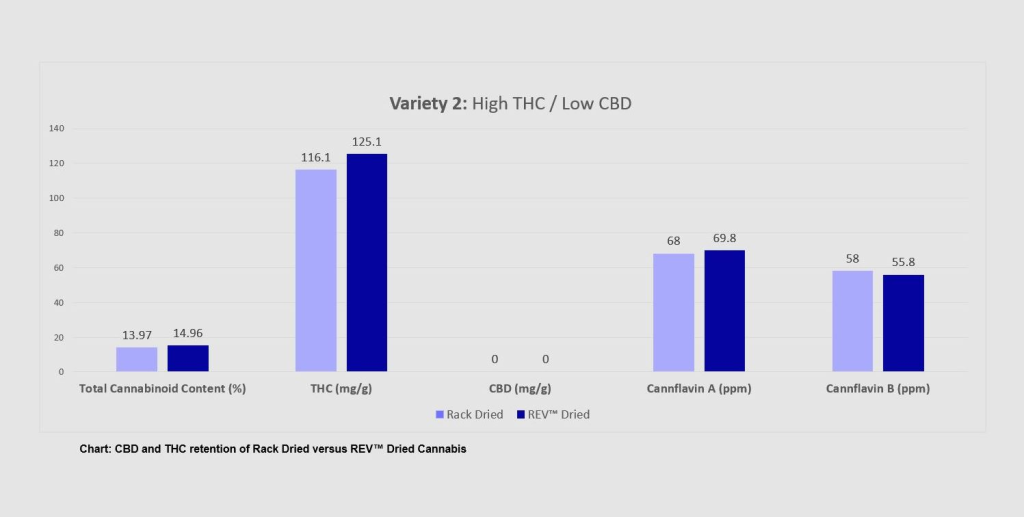

Data collected from the many trials completed using REV™ technology to dry cannabis have allowed our personnel to improve the processes implemented and have resulted in improved yields, appropriate terpene levels and virtually 100% cannabinoid retention. We now believe that REV™ can be used for the production of both combustible flower and plant material intended for extraction.

Moving forward, it will be imperative that our team successfully delivers Good Manufacturing Practice (“GMP”) REV™ machinery to cannabis companies operating in Europe, Australasia and other jurisdictions that require robust traceability of manufacture. We are currently working to finalize the first GMP purchase order from Aurora for their Danish facility in Q1 fiscal 2020. If successful, EnWave will be the only known manufacturer of GMP continuous vacuum-microwave dehydration machinery for the cannabis space. GMP REV™ machines will sell for approximately two to three times more than non-GMP REV™ machinery due to material upgrades and traceability requirements. This is a result, in part, of our hiring of new and highly capable technical staff.

Food Application Royalty Partner Pipeline

Due to the general opaqueness of prospective partners’ efforts and long project timelines, the ability to accurately project sales in the food industry has historically proven to be difficult. As more and more royalty partners have become commercially successful, the verticals in which they operate have been validated. Thus far, Dairy, Fruit and Vegetable applications have proven to be commercially viable. Meat, Seafood and Ready-to-Eat meal applications are still in the process of being proven at commercial-scale. Several projects in these verticals are active and we anticipate commercial success will ultimately result.

The first commercial REV™-dried application was blueberries in 2009 via a license with Cal-San Enterprises. Since then, EnWave has granted an additional twelve licenses for the production of various fruit and vegetable products and eleven licenses to dairy companies.

The total annual revenue generated from the sale of food dryers (freeze, air, spray etc.) is expected to reach over $10 BN per annum by 2025 (Source: Grand View Research, Data Monitor). We will continue to carve out market share, discover new value-added applications and leverage our commercial successes.

NutraDried Food Company: Strategic Approach by Proven Team

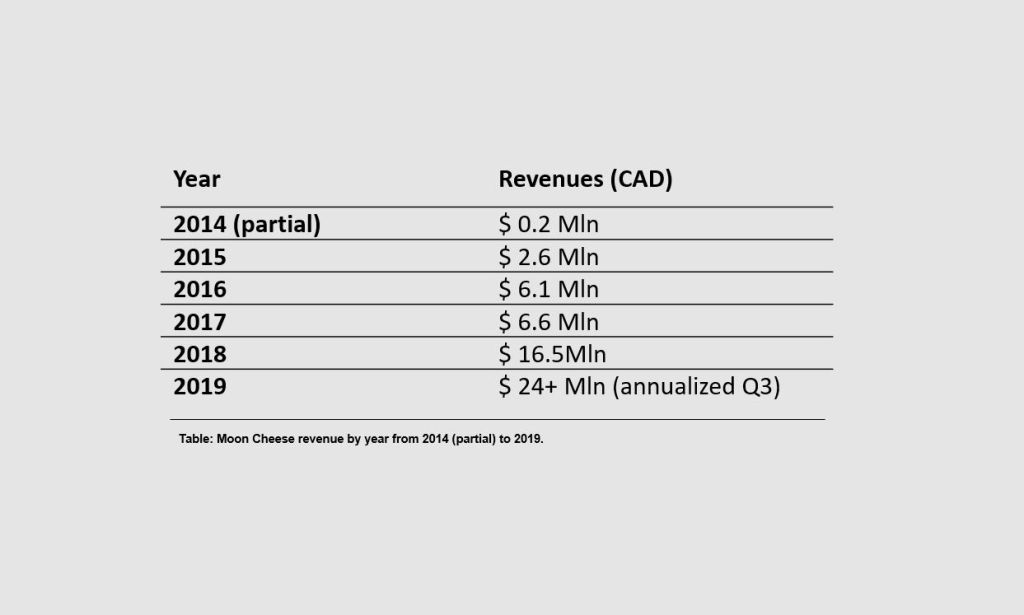

NutraDried Food Company, our wholly-owned subsidiary, is experiencing significant growth. To give you a sense of NutraDried’s dramatic growth, and why we are so enthusiastic about its potential, please refer to the following:

The leadership and guidance that our new CEO, Mike Pytlinski, has demonstrated this past year has been outstanding. He has built a highly competent team of experienced consumer packaged goods personnel who have constructed a logical and realistic strategic plan to grow NutraDried’s revenues at a robust CAGR. In fiscal 2020 the sales leadership at NutraDried will be focused on distribution expansion into the foodservice, c-store, natural and club ecosystems, as well as significant growth in retail grocery. Additionally, NutraDried relaunched the Moon Cheese brand in September including the introduction of two new flavors – Garlickin’ Parmesan and Cheddar Bacon Me Crazy. NutraDried plans to add new formats to its product portfolio, selling Moon Cheese in a 1-ounce single serve pack to compliment the current 2-ounce and 10-ounce pack sizes.

EnWave’s executive leadership will continue to work closely with NutraDried’s team to increase Moon Cheese’s position as the premier all-natural cheese snack brand in North America. We are committed to allocating the necessary resources to stimulate future NutraDried success. NutraDried will continue to be a primary contributor to EnWave’s financial performance. Through Q3 fiscal 2019, NutraDried generated approximately $18 MM in revenue and we expect a very strong Q4 tied to the Most Valuable Member (“MVM”) promotion throughout the Costco ecosystem, which wrapped-up in September.

Historically NutraDried has yielded a very attractive margin profile; however, a conscious effort to grow the business through investment in people and infrastructure will compress margins in fiscal 2020. We expect the investment we make in 2020 to payoff and increase margin profile in fiscal 2021. We are focused on dramatically improving topline performance and securing significant market share to support meaningful long-term value creation for our stakeholders.

The run rate on a single 100kW nutraREV® line is in the order of $15 to $20 MM topline revenue. NutraDried currently has two 100kW production lines running flat out and we will likely have to expand this capacity in fiscal 2020. Our customer base has significantly broadened and revenue generated from Starbucks and Costco, our two largest customers, is growing. EBITDA margins are healthy and the business unit is profitable.

Prospective Path to Profitability

EnWave’s financial performance through the first three quarters of fiscal 2019 was the best in the history of the company. We expect Q4 fiscal 2019 to continue this trend. On a consolidated basis we aim to deliver further improvement in fiscal 2020.

As we sell more REV™ machines, our margins will improve. As we install the already purchased base of cannabis machinery, we will begin to generate royalties from the cannabis vertical, which will contribute towards achieving profitability on a stand-alone basis. New and incremental machine sales and installations will contribute materially on our path to profitability.

NutraDried is expected to be profitable on an ongoing basis. Due to our planned investment into NutraDried’s trade spending, marketing and sales efforts in fiscal 2020, NutraDried’s profitability will likely remain flat during fiscal 2020, but should improve meaningfully in fiscal 2021.

Together our two businesses will continue to offer stakeholders very attractive upside and diversified unique investment propositions. We have worked hard to improve our team’s capabilities, build our infrastructure and drive business development. The future prospects of our business have never been as good as we advance down the path towards profitability.

Best regards,

Brent Charleton, CFA

President and CEO

EnWave Corporation

DOWNLOAD THIS RELEASE

About EnWave

EnWave Corporation, a Vancouver-based advanced technology company, has developed Radiant Energy Vacuum (“REV™”) – an innovative, proprietary method for the precise dehydration of organic materials. REV™ technology’s commercial viability has been demonstrated and is growing rapidly across several market verticals in the food, legal cannabis and pharmaceutical sectors. EnWave’s strategy is to sign royalty-bearing commercial licenses with industry leaders in multiple verticals for the use of REV™ technology. The company has signed over twenty royalty-bearing licenses to date, opening up eight distinct market sectors for commercialization of new and innovative products. In addition to these licenses, EnWave has formed a Limited Liability Partnership, NutraDried LLP, to develop, manufacture, market and sell all-natural cheese snack products in the United States under the Moon Cheese® brand.

EnWave has introduced REV™ as the new dehydration standard in the food and biological material sectors: faster and cheaper than freeze drying, with better end product quality than air drying or spray drying. EnWave currently has three commercial REV™ platforms:

1. nutraREV® which is used in the food industry to dry food products quickly and at low-cost, while maintaining high levels of nutrition, taste, texture and colour; and

2. quantaREV® which is used for continuous, high-volume low-temperature drying.

More information about EnWave is available at www.enwave.net.

EnWave Corporation

Dr. Tim Durance

President & CEO

For further information:

John Budreski, Executive Chairman at +1 (416) 930-0914

E-mail: jbudreski@enwave.net

Brent Charleton, Senior Vice President, Sales and Business Development at +1 (778) 378-9616

E-mail: bcharleton@enwave.net

Deborah Honig, Corporate Development, Adelaide Capital Markets at + 1 (647) 203-8793

E-mail: dhonig@enwave.net

Safe Harbour for Forward-Looking Information Statements: This press release may contain forward-looking information based on management’s expectations, estimates and projections. All statements that address expectations or projections about the future, including statements about the Company’s strategy for growth, product development, market position, expected expenditures, and the expected synergies following the closing are forward-looking statements. All third party claims referred to in this release are not guaranteed to be accurate. All third party references to market information in this release are not guaranteed to be accurate as the Company did not conduct the original primary research. These statements are not a guarantee of future performance and involve a number of risks, uncertainties and assumptions. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.