EnWave Announces 2021 First Quarter Consolidated Interim Financial Results

VANCOUVER, FEBRUARY 26, 2021 6:00AM

EnWave Corporation (TSX-V:ENW | FSE:E4U) (“EnWave”, or the “Company”) is pleased to report the Company’s consolidated interim financial results for the first quarter ended December 31, 2020.

EnWave’s annual and interim consolidated financial statements and MD&As are available on SEDAR at www.sedar.com and on the Company’s website www.enwave.net.

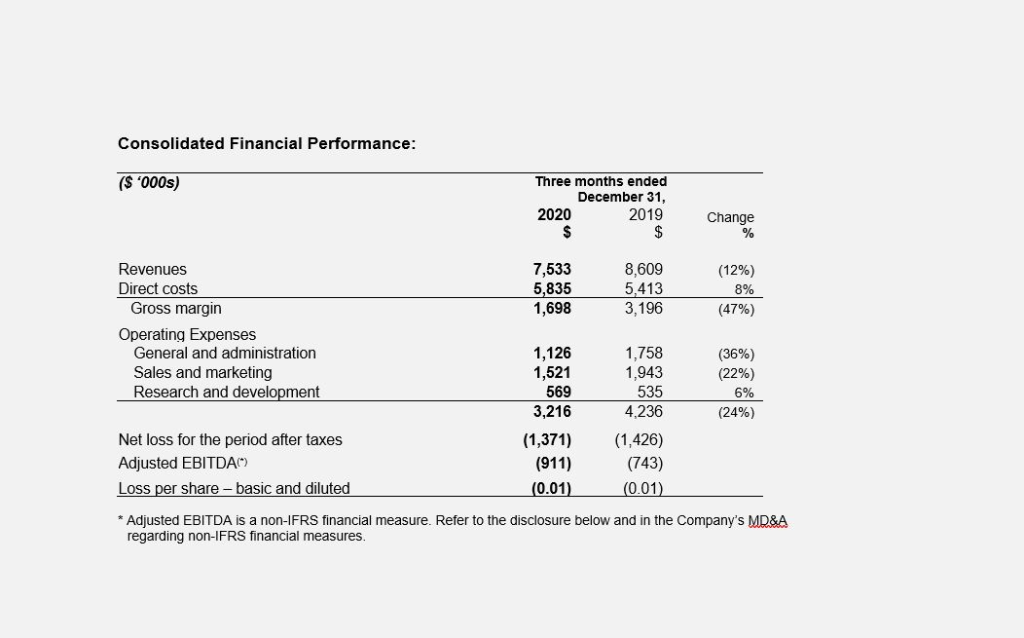

Key Financial Highlights for Q1 (expressed in ‘000s):

- Reported consolidated revenue for Q1 2021 of $7,533 compared to $8,609 for Q1 2020, a decrease of $1,076 or 12%. EnWave Canada had revenue of $2,676 in Q1 2021 compared to $4,555 in Q1 2020. NutraDried had revenue of $4,857 in Q1 2021 compared to $4,054 in Q1 2020.

- Gross margin was 23% for Q1 2021 compared to 37% for Q1 2020. The gross margin compression in Q1 2021 was due to a one-off discount offered by NutraDried on a national Moon Cheese® promotion at Costco.

- Consolidated net loss after taxes was $1,371 for Q1 2021 compared to a net loss of $1,426 for Q1 2020, an improvement of $55.

- EnWave reported a segment loss of $25 for Q1 2021 compared to a segment loss of $790 for Q1 2020, an improvement of $765. The improvement in EnWave’s segment results is attributed to the cost containment measures implemented in fiscal year 2020 and improved operating leverage with new REV™ machinery orders.

- NutraDried reported a segment loss of $1,346 for Q1 2021 compared to a segment loss of $636 for Q1 2020.

- Adjusted EBITDA(*) was a loss of $911 for Q1 2021 compared to a loss of $743 for Q1 2020, an increase of $168.

- SG&A expenses (inclusive of R&D expenses) for Q1 2021 were $3,216 compared to $4,236 for Q1 2020, a decrease of $1,020 or 24%. SG&A expenses were lower as a result of a cost containment plan implemented to reduce costs and eliminate non-essential and discretionary expenses while remaining focused on commercialization growth across the business.

- Generated cash from operating activities in Q1 2021 of $4,228 compared to cash used in operating activities in Q1 2020 of $2,796.

- Maintained a strong balance sheet with a working capital surplus of $22,221 and a cash balance of $17,401. Our cash position has notably increased from Q4 2020, giving the Company a robust treasury to further the expansion of the global deployment of REVTM technology, which includes the build-out of the REVworx™ toll manufacturing facility and furthering the research and development in using REV™ for the rapid, gentle drying of cannabis products.

Significant Corporate Accomplishments in Q1 2021:

Significant accomplishments made during Q1 2021 and to the date of this report include:

- Confirmed an order for a 100kW REV™ machine from Patatas Fritas Torres, a royalty partner of the Company producing cheese snack products in Spain. The purchase of the 100kW machine marks the scale-up from a 10kW machine of another global dairy partner for the large-scale production of shelf-stable cheese snacks.

- Secured a purchase order to deliver two 10kW REV™ machines to Natural Nutrition, a royalty partner of the Company in Chile, to increase its royalty-bearing processing capacity for premium dried fruit and vegetable products.

- Secured a purchase order to deliver the second 10kW REV™ machine to the US Army for the development of unique and nutrient stable food ration products for their soldiers.

- Secured a purchase order for a 10kW REV™ machine from Responsible Foods, a royalty partner of the Company producing premium dried snacks using healthy Icelandic ingredients. The purchase of the 10kW machine doubles Responsible Foods’ royalty-bearing manufacturing capacity in Iceland.

- Signed an exclusive royalty bearing license with Nippon Trends Food Service, Inc. (“Nippon Trends”) for the use of EnWave’s dehydration technology for the commercial production of ready-to-eat ramen noodle products. Nippon Trends purchased a 10kW REV™ machine to initiate commercial production in Canada.

- Signed the first royalty-bearing commercial license agreement for cannabis dehydration in the United States with HHC Holdings, LLC d.b.a. GentleDry Technologies. GentleDry Technologies will initiate commercial production with a 10kW REV™

- Advanced the joint development agreement with GEA Lyophil GmbH (“GEA”) for the development and scale-up of GMP-pharma machinery for the global pharmaceutical industry. GEA has purchased a lab-scale REV™ machine for installation at its pilot facility in Hürth, Germany, and plans to utilize the machine to showcase the capabilities of microwave-assisted lyophilization technology to prospective target customers.

- Developed Terpene Max™, a proprietary drying protocol for cannabis that dries cannabis material at temperatures lower than 40 degrees Celsius. The first quantitative analysis performed by an independent testing facility shows that flower dried using Terpene Max™ retained 88% of the terpenes when compared to the fresh flower and when compared to room dried cannabis flower, the Terpene Max™ process yielded 10% more terpenes than the room dried flower.

- Completed the installation of two 100kW REV™ machines for royalty-bearing commercial production in Costa Rica and Peru respectively for the processing of premium shelf-stable fruit and vegetable products.

- Completed the fabrication and shipped two 120kW machines to Aurora Cannabis. EnWave has received full payment for these two machines from Aurora Cannabis.

Business Transformation at NutraDried:

The Company previously announced on February 18, 2021, a restructuring and cost reduction plan implemented at NutraDried, a wholly owned subsidiary of the Company. As part of the restructuring, certain management and production staffing positions were eliminated to realign the cost structure of NutraDried to realize material savings. The reductions to staffing are expected to lower annual personnel costs to the Company by approximately CA $2 million; the Company will incur a severance charge in Q2 2021 of approximately CA $600,000 as part of the restructuring. The total monthly FTE expenses at NutraDried will be reduced by approximately 30% following the organizational changes.

The changes announced are part of a plan to reduce expenses across NutraDried’s operations, regain focus on the core competencies of the business and to return the business to meaningful profitability through the use of REV™ technology. The objective is to return NutraDried to positive EBITDA and cash flows as quickly as possible while continuing to innovate and launch new REV™ products that align with consumer preferences.

Part of the new strategy will include proactively seeking contract manufacturing opportunities to leverage the installed REV™ capacity. Recently, NutraDried secured a major contract manufacturing opportunity with a leading global snack company to supply REV™-dried cheese. There are several additional private-label and contract manufacturing projects in NutraDried’s pipeline.

Conference Call Details:

Date: March 1, 2021

Time: 7:00am PST / 10:00am EST

Participant Access: 1-877-407-2988 (toll free number)

Webcast Link: https://78449.themediaframe.com/dataconf/productusers/enw/mediaframe/43699/indexl.html

DOWNLOAD THIS RELEASE

(*) Non-IFRS Financial Measures:

Adjusted EBITDA is not a measure of financial performance under IFRS. We define Adjusted EBITDA as earnings before deducting amortization and depreciation, stock-based compensation, foreign exchange gain or loss, finance expense or income, income tax expense or recovery and non-recurring impairment, restructuring and severance charges and government assistance. This measure is not necessarily comparable to similarly titled measures used by other companies and should not be construed as an alternative to net income or cash flow from operating activities as determined in accordance with IFRS. Please refer to the discussion included in the Company’s interim MD&A for the three months ended December 31, 2020.

About EnWave

EnWave Corporation, a Vancouver-based advanced technology company, has developed a Radiant Energy Vacuum (“REV™”) – an innovative, proprietary method for the precise dehydration of organic materials. EnWave has further developed patented methods for uniformly drying and decontaminating cannabis through the use of REV™ technology, shortening the time from harvest to marketable cannabis products.

REV™ technology’s commercial viability has been demonstrated and is growing rapidly across several market verticals in the food, and pharmaceutical sectors, including legal cannabis. EnWave’s strategy is to sign royalty-bearing commercial licenses with innovative, disruptive companies in multiple verticals for the use of REV™ technology. The company has signed over thirty royalty-bearing licenses to date. In addition to these licenses, EnWave established a Limited Liability Corporation, NutraDried Food Company, LLC, to manufacture, market and sell all-natural dairy snack products in the United States, including the Moon Cheese® brand.

EnWave has introduced REV™ as the new dehydration standard in the food and biological material sectors: faster and cheaper than freeze drying, with better end product quality than air drying or spray drying. EnWave currently has three commercial REV™ platforms:

1. nutraREV® which is used in the food industry to dry food products quickly and at low-cost, while maintaining high levels of nutrition, taste, texture and colour; and

2. quantaREV® which is used for continuous, high-volume low-temperature drying.

More information about EnWave is available at www.enwave.net.

EnWave Corporation

Mr. Brent Charleton, CFA

President & CEO

For further information:

Brent Charleton, CFA

President & CEO at +1 (778) 378-9616

E-mail: bcharleton@enwave.net

Dan Henriques, CA, CPA,

Chief Financial Officer at +1 (604) 835-5212

E-mail: dhenriques@enwave.net

For Media Inquiries:

Email: media@enwave.net

Safe Harbour for Forward-Looking Information Statements: This press release may contain forward-looking information based on management’s expectations, estimates and projections. All statements that address expectations or projections about the future, including statements about the Company’s strategy for growth, product development, market position, expected expenditures, and the expected synergies following the closing are forward-looking statements. All third party claims referred to in this release are not guaranteed to be accurate. All third party references to market information in this release are not guaranteed to be accurate as the Company did not conduct the original primary research. These statements are not a guarantee of future performance and involve a number of risks, uncertainties and assumptions. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.