EnWave Announces 2021 Second Quarter Consolidated Interim Financial Results

VANCOUVER, MAY 27, 2021 6:00AM

EnWave Corporation (TSX-V:ENW | FSE:E4U) (“EnWave”, or the “Company”) today reports the Company’s consolidated interim financial results for the second quarter ended March 31, 2021.

EnWave’s annual and interim consolidated financial statements and MD&As are available on SEDAR at www.sedar.com and on the Company’s website www.enwave.net.

Key Financial Highlights for Q2 (expressed in ‘000s):

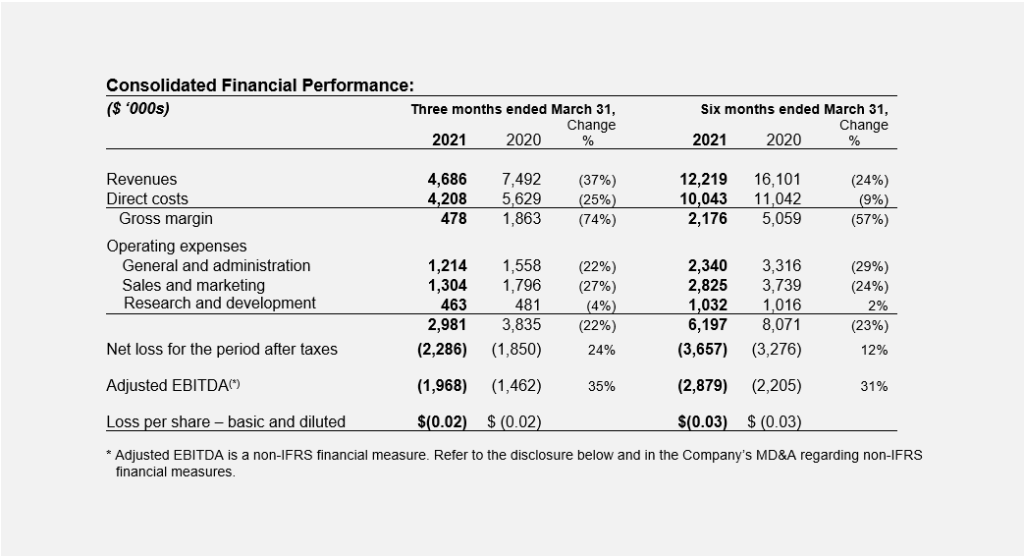

- Reported consolidated revenue for Q2 2021 of $4,686 compared to $7,492 for Q2 2020, a decrease of $2,806 or 37%.

- Revenue from EnWave in Q2 2021 was $2,348 compared to $2,169 in Q2 2020, an increase of $179 or 8%. The increase in revenue was due to higher Radiant Energy Vacuum (“REV™”) machine rentals for technology evaluation purposes and higher customized REV™” machinery sales in the food and cannabis verticals.

- Revenue from NutraDried in Q2 2021 was $2,338 compared to $5,323 in Q2 2020, a decrease of $2,985 or 56%. NutraDried revenues were downwardly impacted by fewer rotations with Costco, partially offset by some growth in the online channels.

- Gross margin for Q2 2021 was 10% compared to 25% for Q2 2020. The margin compression in Q2 2021 was due to lower manufacturing cost absorption at NutraDried with manufacturing overhead being allocated over reduced production volume. NutraDried also recorded an inventory write-off provision of $213 during the period. EnWave’s segment gross margin improved to 40% during the quarter as the REV™ business continued to benefit from a more variable cost structure while reducing fixed manufacturing overhead expenses.

- Consolidated net loss after taxes was $2,286 for Q2 2021 compared to a net loss $1,850 for Q2 2020.

- EnWave reported positive segment net income of $42 for Q2 2021 compared to a segment loss of $1,134 for Q2 2020, an improvement of $1,176. The improvement in EnWave’s segment results is attributed to the growth in REV™ machinery orders paired with measures implemented to reduce costs in all areas of the business.

- NutraDried reported a segment loss of $2,328 for Q2 2021 compared to a segment loss of $716 for Q2 2020. This increase is primarily due to the one-time severance charge of $691 for the restructuring of NutraDried, as well as lower gross margins due to not having Costco rotations during the period. In February 2021, the Company announced a restructuring of NutraDried and has taken significant steps to reduce NutraDried’s expenses and increase manufacturing output.

- Adjusted EBITDA(*) was a loss of $1,968 for Q2 2021 compared to a loss of $1,462 for Q2 2020, an increase of $506.

- SG&A expenses (inclusive of R&D expenses) for Q2 2021 were a combined $2,981 compared to $3,835 for Q2 2020 and $3,216 for Q1 2021. The Company reduced SG&A expenses by reducing non-essential spending and discretionary expenses while remaining focused on the core competencies of the business and planning for future growth.

- Continue to maintain a strong balance sheet with a working capital surplus of $19,275 and a cash position of $15,403. We are in a strong position to pursue further growth in the expansion of the global deployment of REV™ technology, which includes the build-out of the REVworx™ toll manufacturing facility which is expected to be operational by the end of the fiscal year.

Significant Corporate Accomplishments in Q2 2021:

Significant accomplishments made during Q2 2021 and to the date of this report include:

- Signed a royalty-bearing commercial license agreement with a leading Illinois-based cannabis company to produce cannabis products and received a purchase order for both a large-scale 120kW machine and a 10kW pilot-scale REV™

- Signed a royalty-bearing commercial license agreement with AvoLov, LLC (d.b.a. “BranchOut”) and sold a 60kW large-scale REV™ machine to initiate production of a line of “better-for-you” avocado and fruit products.

- Completed the sale of a 10kW REV™ machine to NuWave Foods, Inc., who was previously on a Technology Evaluation and License Option Agreement, for the commercial launch of new and innovative shelf-stable bakery products.

- Received a purchase order to deliver a 10kW REV™ machine to Dairy Concepts IRL (“DCI”) for the development of a portfolio of natural, sweet and savoury, shelf-stable, hand-held dairy snacks.

- The US Army submitted a purchase order for the delivery of a second 10kW REV™ machine for the accelerated development of unique, lighter and nutrient-dense food ration products for soldiers. The machine will be placed at the Bridgford Foods Corporation (NASDAQ: BRID) manufacturing facility for the joint development of commercially viable military ration components.

- Natural Nutrition, the Company’s royalty partner in Chile, purchased two additional 10kW REV™ machines for installation in the agriculturally rich Northern Patagonia region of Chile to increase its royalty-bearing processing capacity for premium dried fruit and vegetable products.

- Received a purchase order for a 10kW REV™ machine from Responsible Foods, a royalty partner of the Company producing premium dried snacks using healthy Icelandic ingredients. The purchase of the 10kW machine doubles Responsible Foods’ royalty-bearing manufacturing capacity in Iceland.

- Completed the installation and start-up of two 100kW REV™ machines for Pitalia and Consulting Fresh Business S.L. in Costa Rica and Peru, respectively. Both companies began commercial production during fiscal Q2 and pays EnWave a royalty based on a percentage of revenue generated from REV™ product sales.

- Signed three new Technology Evaluation and License Option Agreements with companies conducting intensive product development and evaluation on the use of REV™ technology to bring innovative new products to market.

- NutraDried launched a new Protein Blitz Mix product in three flavours (Gouda Pecan Zesty Ranch, Almond Crazy Cheesy, Sweet Heat) which is available in various package sizes ranging from 1oz to 15oz that have been customized to suit specific channels of distribution.

- Completed a material restructuring at NutraDried with the objective to restore the operating subsidiary to sustainable profitability. The Company parted ways with the former CEO of NutraDried and took significant steps to remove excess staffing, marketing and SG&A expenses from the business, the benefit of which will be realized in the second half of 2021. Starting in Q3, NutraDried has successfully started to build a co-manufacturing business for the sale of shelf-stable cheese as ingredients in other snack products and mixes, and current management plan to leverage the installed REV™ capacity to bring additional products to market.

- Announced that Merck published a research paper citing the Company’s freezeREV® process as a viable manufacturing alternative to vial-based lyophilization for vaccines and biologics, while emphasizing the need for accelerated vaccine development and on-demand, flexible manufacturing options especially in this global pandemic environment.

- Repurchased and cancelled 40,000 common shares under the normal course issuer bid for a total cost of $53 at a volume weighted average price of $1.32 per common share.

تفاصيل المكالمة الجماعية:

Date: May 27, 2021

Time: 7:00am PST / 10:00am EST

Participant Access: 1-877-407-2988 (toll free number)

Webcast Link:

https://78449.themediaframe.com/dataconf/productusers/enw/mediaframe/45178/indexl.html

DOWNLOAD THIS RELEASE

(*) Non-IFRS Financial Measures:

Adjusted EBITDA is not a measure of financial performance under IFRS. We define Adjusted EBITDA as earnings before deducting amortization and depreciation, stock-based compensation, foreign exchange gain or loss, finance expense or income, income tax expense or recovery and non-recurring impairment, restructuring and severance charges and government assistance. This measure is not necessarily comparable to similarly titled measures used by other companies and should not be construed as an alternative to net income or cash flow from operating activities as determined in accordance with IFRS. Please refer to the discussion included in the Company’s interim MD&A for the six months ended March 31, 2021.

نبذة عن EnWave

قامت شركة EnWave Corporation، وهي شركة تكنولوجيا متقدمة مقرها فانكوفر، بتطوير تقنية تفريغ الطاقة المشعة ("REV™") - وهي طريقة مبتكرة مسجلة الملكية لتجفيف المواد العضوية بدقة. وقد طورت EnWave كذلك طرقًا حاصلة على براءة اختراع لتجفيف القنب بشكل موحد وإزالة التلوث من خلال استخدام تقنية REV™، مما يقلل من الوقت من الحصاد إلى منتجات القنب القابلة للتسويق.

وقد تم إثبات الجدوى التجارية لتقنية REV™، وهي تنمو بسرعة في العديد من قطاعات السوق في قطاعات الأغذية والأدوية، بما في ذلك القنب القانوني. وتتمثل استراتيجية EnWave في توقيع تراخيص تجارية مع شركات مبتكرة ومبتكرة في قطاعات متعددة لاستخدام تقنية REV™. وقد وقّعت الشركة أكثر من ثلاثين ترخيصًا تجاريًا خاضعًا للإتاوات حتى الآن. وبالإضافة إلى هذه التراخيص، أنشأت شركة EnWave شركة ذات مسؤولية محدودة، وهي شركة NutraDried Food Company, LLC، لتصنيع وتسويق وبيع منتجات الألبان الخفيفة الطبيعية بالكامل في الولايات المتحدة، بما في ذلك العلامة التجارية Moon Cheese®.

قدمت EnWave تقنية REV™ كمعيار جديد للتجفيف في قطاعي الأغذية والمواد البيولوجية: أسرع وأرخص من التجفيف بالتجميد، مع جودة منتج نهائي أفضل من التجفيف بالهواء أو التجفيف بالرذاذ. ولدى EnWave حاليًا ثلاث منصات تجارية لـ REV™:

1. nutraREV®الذي يستخدم في صناعة الأغذية لتجفيف المنتجات الغذائية بسرعة وبتكلفة منخفضة، مع الحفاظ على مستويات عالية من التغذية والطعم والملمس واللون؛ و

2. quantaREV®الذي يستخدم للتجفيف المستمر ذي الحجم الكبير في درجات الحرارة المنخفضة.

يتوفر المزيد من المعلومات عن EnWave على www.enwave.net.

شركة EnWave

السيد برنت تشارلتون، CFA

الرئيس والمدير التنفيذي

للمزيد من المعلومات

برنت تشارلتون، CFA

الرئيس والمدير التنفيذي على الرقم +1 (778) 378-378-9616

البريد الإلكتروني: bcharleton@enwave.net

دان هنريكس، محاسب قانوني معتمد، محاسب قانوني معتمد،

المدير المالي على الرقم +1 (604) 835-5212 (604) 835-5212

البريد الإلكتروني: dhenriques@enwave.net

للاستفسارات الإعلامية:

البريد الإلكتروني: media@enwave.net

الملاذ الآمن لبيانات المعلومات التطلعية: قد يحتوي هذا البيان الصحفي على معلومات تطلعية مبنية على توقعات الإدارة وتقديرات وتوقعات الإدارة. إن جميع البيانات التي تتناول التوقعات أو التوقعات حول المستقبل، بما في ذلك البيانات المتعلقة باستراتيجية الشركة للنمو، وتطوير المنتجات، والمكانة السوقية، والنفقات المتوقعة، والنفقات المتوقعة، وأوجه التآزر المتوقعة بعد الإغلاق، هي بيانات تطلعية. جميع ادعاءات الطرف الثالث المشار إليها في هذا البيان غير مضمونة الدقة. جميع إشارات الطرف الثالث إلى معلومات السوق الواردة في هذا البيان الصحفي غير مضمونة الدقة لأن الشركة لم تقم بإجراء البحث الأساسي الأصلي. هذه البيانات ليست ضمانة للأداء المستقبلي وتنطوي على عدد من المخاطر والشكوك والافتراضات. وعلى الرغم من أن الشركة حاولت تحديد العوامل المهمة التي يمكن أن تتسبب في اختلاف النتائج الفعلية بشكل جوهري، إلا أنه قد تكون هناك عوامل أخرى تتسبب في أن تكون النتائج غير متوقعة أو مقدرة أو مقصودة. لا يمكن أن يكون هناك أي ضمان بأن مثل هذه البيانات ستكون دقيقة، حيث يمكن أن تختلف النتائج الفعلية والأحداث المستقبلية بشكل جوهري عن تلك المتوقعة في مثل هذه البيانات. وبناءً على ذلك، يجب على القراء عدم الاعتماد بشكل غير مبرر على البيانات التطلعية.

لا تقبل بورصة الأوراق المالية TSX Venture Exchange ولا مزود الخدمات التنظيمية التابع لها (كما هو معرّف في سياسات بورصة الأوراق المالية TSX Venture Exchange) المسؤولية عن كفاية أو دقة هذا البيان.